Fixed asset turnover ratio (FATR) is a measure of a company’s operational efficiency that is often used by analysts. In order to

measure how well a company can produce sales from its investments in fixed assets, such as property, plant, and equipment (PP&E), net

sales are compared to fixed assets on the balance sheet (PP&E).

The fixed asset balance is used to calculate the net of depreciation. The fact that a firm’s fixed asset turnover ratio is higher than the industry average indicates that the company has made good use of its capital expenditures by converting those assets into income.

These Are Important Points To Reminder

- The turnover ratio of a company’s fixed assets can be used to determine how effectively the company uses its existing fixed assets to

produce income. - Another way of saying this is that a higher utilization ratio suggests that management is making better use of its fixed assets.

- No relationship exists between a high FAT ratio and a company’s ability to generate significant earnings or cash flows.

Knowing How To Measure The Turnover Of Fixed Assets

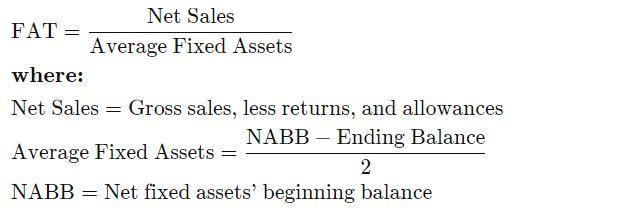

The following is the formula for calculating the fixed asset turnover ratio:

The ratio is a common statistic in industrial organizations that purchase a large amount of PP&E in order to increase output. In the

event that a company makes a major purchase like this, smart investors will keep an eye on this ratio to see if the company’s new fixed assets will result in increased sales in the following years.

An organization’s total assets are mostly comprised of investments in fixed assets. The yearly FAT ratio calculation allows a company’s

management team to assess how efficiently these significant assets have been leveraged to generate income for the firm as a whole over a given period of time.

The Fixed Asset Turnover Ratio: A Guide To Its Use And Interpretation

The effectiveness of a firm in generating revenue from fixed-asset investments is not determined by a precise metric or range of metrics,

however a higher turnover ratio is indicative of greater effectiveness in managing these investments. Accordingly, analysts and investors should compare the most recent ratio of a company to its own historical ratios, as well as ratio values from peer businesses and/or the average ratio of the industry as a whole, if appropriate. This is necessary due to the fact that

It is critical to determine whether the company under consideration is in the correct sector or industry before placing too much emphasis on

the FAT ratio calculation, despite the fact that it is important in some industries.

It is possible that the disparities in fixed assets between one type of firm and another are quite significant. Consider the disparity between a manufacturing company and an internet-based organization, for example. When it comes to fixed assets, there is a significant contrast between an internet firm such as Meta (formerly Facebook) and a manufacturing behemoth such as Caterpillar. Caterpillar’s fixed asset turnover ratio is clearly more relevant than Meta’s fixed asset turnover ratio, and as a result, Caterpillar’s FAT ratio should be given more weight in this scenario.

There Is A Considerable Discrepancy Between The Asset Turnover Ratio And The Fixed Asset Turnover Ratio.

The asset turnover ratio, rather than the fixed asset turnover ratio, takes into account all assets rather than just fixed assets. Total

assets are one of the indicators of management decisions on capital expenditures and other assets, as is total assets.

The Fixed Asset Ratio’s Restrictive Nature

Companies with cyclical sales may have lower ratios during slow periods; as a result, the ratio should be analyzed over a longer period

of time to determine its true significance. As another example, management may be outsourcing production in order to reduce its reliance

on fixed assets while also attempting to maintain steady cash flows and other fundamentals of the company.

It is possible for organizations with high asset turnover ratios to yet be losing money, because the number of sales generated by fixed

assets tells nothing about the company’s ability to create excellent profits or maintain a healthy cash flow.