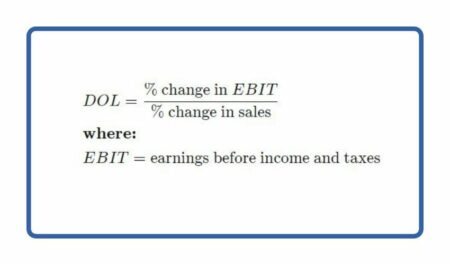

The degree of operational leverage (DOL) is a multiplier for a company’s operating income that is used to evaluate how much the company’s operating income will fluctuate in response to changes in revenue. A higher proportion of fixed expenses (i.e., costs that do not fluctuate in response to production) than variable expenses is found in firms that have a higher level of operating leverage.

It is possible for analysts to utilize the DOL ratio to determine what influence a change in sales has on a company’s profitability or profit margins by utilizing this metric.

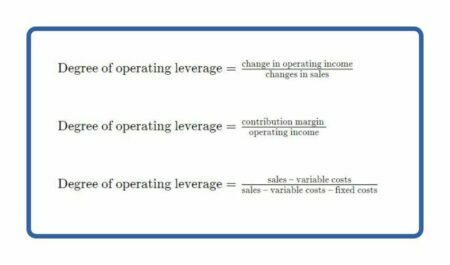

Formula and Calculation for Determining the Degree of Operating Leverage

The core formula mentioned above can be used to compute the DOL in a number of different methods, including the following:

These Are Important Points For You To Learn

- The degree of operating leverage a company has is defined as the amount by which its operating income fluctuates in response to a change in sales.

- Analysts can use the DOL ratio to determine how a change in sales affects earnings.

- When you consider that a large portion of a company’s costs are fixed, even a slight increase in sales can have a major influence on earnings.

The Operating Leverage Of Your Company Might Reveal A Great Deal About You.

Operating leverage (DOL) has an effect on a company’s EBIT sensitivity to changes in sales, as long as all other variables remain constant in the situation. An examination of a company’s DOL ratio can aid investors in determining the impact of a change in sales on the bottom line.

The ratio of a company’s fixed costs to its overall costs, also known as operating leverage, is calculated. This tool is used to determine the point at which a business is profitable. When sales are adequate to pay all costs, yet profit is nil, the scenario is described as follows: Fixed costs account for a significant portion of the operating expenses of a company that has a high degree of operational leverage. It is possible that a substantial increase in sales will have a major influence on profit as a result. When a corporation has less operating leverage, the amount of its expenses that aren’t fixed rises as a result of this. Each sale, as a result, yields a smaller amount of profit. However, because its fixed expenses are smaller, it does not have to increase sales as much as it would otherwise.

Illustrations Of How To Apply Operating Leverage In A Practical Setting

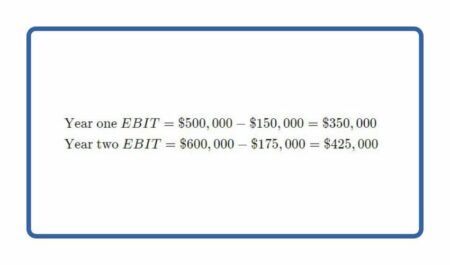

Consider the following scenario: Company X generates $500,000 in sales in its first year of operation. Sales for this product are already approaching $600,000 in its second year. The company’s operational costs for the first year totaled $150,000 dollars. The operating expenditures grew to $175,000 in the second year.

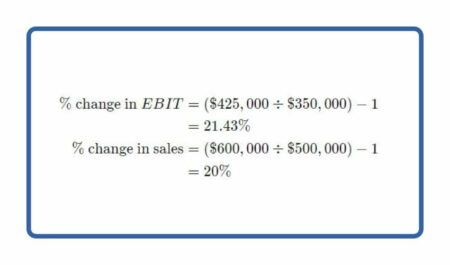

Following that, the percentage change in EBIT values and sales numbers is calculated in the following manner:

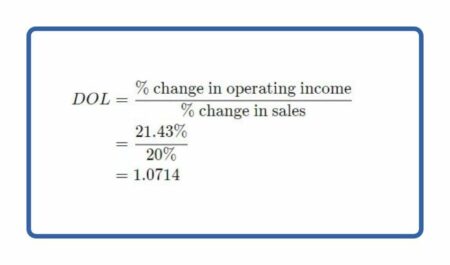

Finally, the DOL ratio is determined as:

Compared To The Degree Of Operating Leverage, The Degree Of Combination Leverage Is More Advantageous.

The combination of operational leverage (Operating Leverage) and the degree of combined leverage (DCL) provides a more full picture of a company’s profitability potential than any of these measures alone. The difference between the percentage change in earnings per share (EPS) and the percentage change in sales is used to compute DOL, which is then multiplied by the degree of financial leverage used to generate it (DFL).

When calculating financial and operating leverage, one method is to compare the ratio of a company’s earnings to the ratio of the company’s assets to the company’s liabilities. Even if a corporation does not use both operational and financial leverage, this strategy can be used to benefit the organization. Therefore, a company with a high level of combined leverage will be viewed as more dangerous, because the higher the level of leverage, the bigger the amount of fixed costs the company will incur.