The processes of planning, creating, and controlling the capital structure of a company are collectively referred to as corporate finance. It seeks to achieve this through making judicious choices about investments, finances, and dividends in order to maximize the organization’s worth and profit. It places an emphasis on capital investments with the goal of satisfying the funding requirements of a company so that the company can achieve an advantageous capital structure.

Main Key Points.

- The process of obtaining and managing financial resources for the purpose of maximizing a company’s growth and value for its shareholders is referred to as corporate finance.

- The investment, finance, and dividend principle are the primary focuses of the concept.

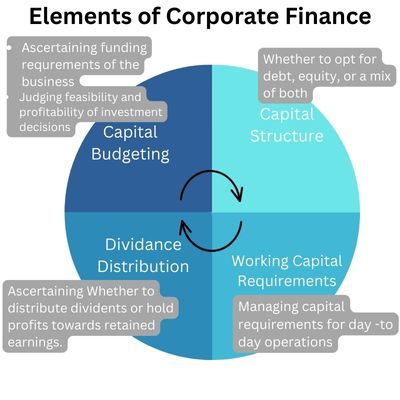

- The primary functional areas include capital budgeting, capital structure, administration of working capital, and choices regarding dividends. The fundamental objective of capital structure decisions, for instance, is determining whether to invest in debt or equity as a medium to raise cash for the company. This is done by weighing the pros and cons of each option.

- This subfield of finance involves a variety of activities, some of which include analyzing the potential risks and rewards of various investment options, assuring the management of working capital, and so on.

What Is The Process Behind Corporate Finance?

Corporate finance places an emphasis on the goal of increasing a company’s and its investors’ financial stability to the greatest extent possible. The primary responsibility of the departments that fall under this division of finance is to handle the financial operations of a firm. They are in charge of making important decisions affecting the organizational budget, investments, and the distribution of capital.

For example, in a real estate investing company, the department computes capital requirements to acquire assets. In addition to this, they will place an emphasis on locating profitable sources of money for asset purchase by making use of the necessary calculations.

Such decisions affect the capital structure of an organization, which refers to the question of whether to finance the business through debt, equity, or some combination of the two. One further component of this section is making sure that the working capital is managed as effectively as possible.

Choosing how much of the company’s profit to keep for themselves versus how much to share with the other shareholders is another crucial factor. The overarching goal of guaranteeing maximum profit should be present in all of these vital decision-making processes.

As a result, employment in corporate finance are in extremely high demand, and a large number of educational institutions now provide training to help individuals acquire the necessary abilities. As an illustration, the annual pay of a corporate finance professional in New York City is approximately $1,24,212 on average.

The distinction between corporate finance and corporate accounting might be difficult to understand at times due to their similarities. The finance team, on the other hand, is responsible for formulating strategies, planning, directing, and carrying out the implementation of those strategies within a business. This is the primary distinction between the two teams. The primary function they serve is to serve as a guide for subsequent performance.

Accounting, on the other hand, is primarily concerned with the tasks of evaluating, recording, tabulating, and reporting on a company’s financial status and transactions. That is to say, it evaluates performance in the past.

The Core Principles Of Corporate Finance

Permit us to walk you through some of the fundamental ideas that underpin this approach.

- The investment concept insists on the relevance of investing in the appropriate options by assessing the risk and return. The investment principle was developed by Ben Graham. The examination of a proposed investment should be based on a predetermined hurdle rate that acts as a standard for the measurement of the return on the investment. It is essential to make certain that the expense of collecting the money does not cancel out the profits that are anticipated.

- The extraction of the greatest possible amount of value from an investment is contingent on adhering to certain financial principles, which direct the choice of financing techniques. The most important decision to make in this situation is whether to obtain funding through stock financing, debt financing, or a combination of the two. The capital structure is influenced by a wide variety of elements, including the form of the firm and its aims, the cost of borrowing, the interest rate, and access to the equity market.

- The dividend principle of an entity discusses whether or not surplus should be funneled toward the growth of the business or distributed as dividends to shareholders.

Central Elements.

The areas of capital budgeting, capital structure, working capital, and dividend decisions are the primary concentrations of attention in corporate finance.

#1 – Capital Budgeting.

The process of capital budgeting reveals whether or not investment proposals are viable and assists with investing in projects that will provide a return. The expansion of the company while maintaining a high level of profitability is the target.

The process of capital budgeting requires financial analysts to consider a number of different investment opportunities. They carry out a comparative examination of the present and future worth of investments in order to assess the risk-return characteristics of those investments in relation to the organization’s goals. Only the initiatives that are the most viable options are considered further.

#2 – Capital Structure.

The method of financing that is utilized by the organization can be deduced from its capital structure. For instance, the capital structure can consist of stock, retained earnings, and debts. From the point of view of investors, it is not a desirable combination to have excessive amounts of either debt or equity.

Instead, they desire a financial structure that is a well-balanced combination of debt and equity. As a consequence of this, the appropriate financial decision results in the ideal combination of numerous forms of funding and increases the value of the organization.

#3 – Working Capital.

The term “working capital” refers to the capital that is used in the day-to-day operations of a firm. An effective administration of finances can guarantee that there is sufficient cash flow in accordance with the policies of the company. Keeping the organization’s liquid assets in good shape can help prevent it from going bankrupt in this manner.

#4 – The Distribution of Dividends

Shareholders are the ones to whom publicly traded firms are accountable. As a consequence of this, they frequently ponder the proportion of the company’s profit that should be paid out in the form of dividends.

If they choose to keep some of the surplus as retained earnings, they absolutely have to be certain that doing so would lead to increased revenue and profits for the company. On the other hand, in order for many businesses to provide their shareholders with a higher level of service, it is necessary for them to pay out a specific amount of dividends.

Different Types of Corporate Finance.

The two primary categories are as follows:

Equity Financing Is Available.

Both the issue of new equity and the use of retained earnings are viable methods for businesses seeking additional funding. Equity can be presented in a variety of forms, including ordinary stock, preference stock, and so on.

To sell its shares, a corporation can either get listed on a stock exchange or participate in over-the-counter (OTC) exchanges. Both of these options are available. An excessive amount of equity will dilute the voting rights of shareholders and will reduce their dividend share.

Debt Financing.

The term “debt financing” refers to the practice of meeting one’s financial needs through taking out loans, most frequently from financial institutions, or issuing bonds, among other methods. The cost of debt financing comes in the form of interest payments made on a regular basis and the repayment of the principal balance at the conclusion of the loan term.

An excessive amount of debt increases the likelihood of defaulting on payments or going bankrupt in the event that the loan cannot be repaid.

Activities Represented as Examples in Corporate Finance

Managing the interplay between firms, assets, markets, investors, the government, financial institutions, and intermediaries is one of the core responsibilities of corporate finance professionals. The following are some examples of activities that fall into this category:

Financial Modeling.

The analysis of the value and risk associated with various investment possibilities can be aided by financial modeling.

Bank Loan.

obtaining a loan from a financial institution in order to satisfy the requirements of a business, as well as carrying out the associated research and analysis to determine the cost of the loan and the ability for payback.

IPO.

The term “initial public offering” (IPO) refers to a method of fundraising that generally helps to raise funds.

Refinancing And Renegotiating Each And Every Payment And Obligation We Have.

As a result of shifts in the market, businesses may choose to engage in strategic negotiation to modify the terms of any loans or other payment agreements they have.

The Distribution Of Dividends:

The distribution of dividends is contingent on the policy that is decided upon by management. It is possible for it to be regular or erratic.

Why Is It Critical To Do This?

The goal of corporate finance is to get funds from the appropriate sources so that day-to-day and long-term financial activities can be managed effectively. It strategizes how a corporation should use and manage its capital in order to achieve the most possible value. It is absolutely necessary to plan adequate capital budgeting and structures in order to achieve a balance between risk and profitability.

Through the use of capital budgeting tools, the management of a company analyses the potential future cash flows from investments. They determine the most cost-effective sources of funding or the optimal proportion of stock to debt in the company’s capital structure. The requirements for working capital are carefully considered with regard to the short-term needs.

Therefore, we are able to state that the organization’s going concern notion is protected as a result of these methods. In addition to this, it enhances the statistical analysis of the financial accounts. As a result, it will maximize value, or more particularly, the stock price will be maximized to its potential.

FAQs.

Making effective business decisions that lead to favorable financial outcomes is the primary responsibility of this function, to put it in the simplest terms possible.

Which three aspects of corporate finance are the most important ones?

The following are some notable areas:

1. Budgeting for capital expenditures

2. Management of working capital

3. Capital structure

When comparing the profitability of two investments, a corporate finance manager may use a discounted payback period. The purpose of this exercise is to calculate the amount of time needed to recoup the initial investment cost and to eliminate any proposals with longer payback periods.

What are the three primary facets of corporate finance, and what are their roles? The field of corporate finance can be broken down into three distinct sub-areas: working capital management, capital structure, and capital budgeting.

The ultimate goal of corporate finance is to maximize the value of a company by the careful planning and application of available resources, all the while maintaining a healthy balance between risk and profit.