The operational cash flow margin of your company is an essential metric that shows you how steady your earnings have been over time. In the case of a $25,000 monthly sales volume, but half of those sales are being returned on a regular basis, it is not a healthy cash flow situation.

By measuring your operational cash flow margin, you can keep track of how lucrative your company is on a regular basis. Using this figure, you may determine how much of your sales is converted into cash, which you can then use to pay your bills.

Being aware of your cash flow metrics might also help you prepare if you’re thinking about expanding or seeking for a loan in the future. This margin will be closely scrutinized by prospective investors and lenders. For you to be more knowledgeable about it than they are is a wise decision.

Profitability ratios are calculated based on the cash flow component that determines your company’s performance. Using these figures, you may determine how effective your performance is. After that, the ratios are divided into margins and returns.

There are courses devoted to teaching you how to utilize this formula, as well as the other formulas required for operating a successful company. However, we’ll break everything down into digestible chunks for you so that you may put off going back to school for the time being.

Discover all you need to know about calculating the operational cash flow margin of your business, as well as tracking the success of your organization!

1. Terms You Should Be Familiar With

Before we get into the cash flow analysis, it’s important to understand exactly what you’re getting yourself into. If you have a bookkeeper or an accountant looking after your money, it is possible that you have not come across these phrases yet.

In any case, as a business owner, you should be aware of what they’re doing as well as how your spending and income are doing. As you go through your reports and calculate your company’s cash flow margin, you’ll come across various accounting phrases that you should be familiar with.

Terms That Are Essential In Business Accounting.

Before you begin analyzing any itemized reports generated by your accounts receivable software, consult this brief glossary to get a sense of what you’ll be looking at:

Cash Flow Is Important.

The manner in which your money goes across your firm, whether physically or online. This might be a transfer from one bank to another (through an expense or income payment), or it could be a straight withdrawal into your hands (bank to person).

Earnings Of High Quality.

In business, the consistency of your profits is referred to as the quality of your earnings. What happens to your profit when you sell something? Do you get to retain the money? Alternatively, do you have a high volume of returns to deal with? The earnings quality is used to forecast how well your company will do in the future.

Margins.

The term “margin” has a distinct meaning in business than it does in everyday speech. An analysis of the gap between the cost to the seller of purchasing their goods or providing their service and the price they charge for it is carried out with this tool. A healthy profit margin can assist to mitigate the effects of slower periods and inflation. The product sales margin of your company is expressed as a percentage of your net sales revenue.

Returns.

It may come as a surprise to hear that returns aren’t necessarily a negative thing in business, as some believe. The term “return” refers to the change in the price of something over a period of time. Your assets, investments, and services all have different monetary values attached to them. A profit has been realized if the value is a positive return on investment. A negative return is equivalent to a loss.

Depreciation.

The term “depreciation” refers to the reduction in the fair worth of an item. For example, the value of a car begins to degrade the moment you drive it off a car dealership lot. It also refers to the manner in which the asset’s initial purchase price depreciates in value over a period of time.

Free Cash Flow Is A Good Thing.

The money you have on hand isn’t always there for you to spend as you wish. Your company’s “free cash flow” is the amount of money left over after all operational expenditures and maintenance have been paid. More information on this may be found in our Cash Flow Estimation Guide.

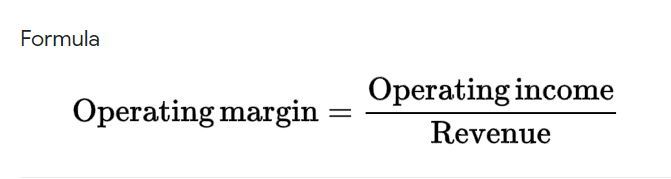

Operating Margin Is The Difference Between Revenue And Expenses.

The operational margin of a firm is calculated using a formula that compares the ratio of your operating income to your net sales. As a mathematical formula, it looks somewhat like this:

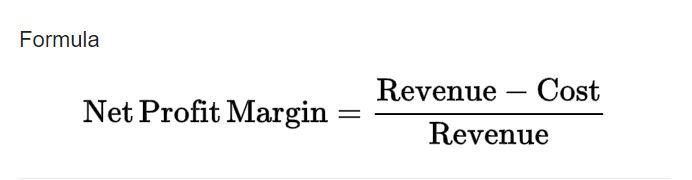

The Net Profit Margin Ratio.

This formula calculates the amount of net income your company has made over the course of the year. It is expressed as a percentage of total revenues collected and is a vital measure of how financially sound your company is performing. Net profit margin may be calculated using the following formula:

Operational Leverage.

This word refers to the process through which a business owner may raise their operational income by increasing their revenue stream. For example, if your firm has a high gross margin of sales paired with low operating expenditures, it would have a high level of operating leverage in that situation.

Understanding these phrases will assist you in doing in-depth analyses of your reports and in having critical talks with your accountant.

2. Making an Estimation of Your Cash Flow Margin.

Whether you’re running a business or working for someone else, you want to make a profit after paying your bills and covering your other costs. However, calculating this profit as a business owner is more difficult than calculating it as a person.

Keeping an eye on your cash flow ratio is an important part of determining the profitability of your company. You may use it to determine how well your firm handles its sales and converts them into cash.

It’s hard to determine whether or not you’re earning a profit unless you know how much of your money is “free” to spend. Having tens of thousands of dollars in revenue per day does not equate to making a profit when you are spending that amount plus more to keep the business running.

Calculating Cash Flow Margins.

This ratio may be used to measure how effectively your company is functioning. It is possible to break your cash flow margin down in depth using the profitability formula, which is divided into margins and returns.

The portion of the ratio that is concerned with margins informs you how successfully your company is converting sales into profits. Once you know how much of your sales is stuck in the system, you may begin to segregate your cash flow from your operating operations.

Making a significant number of sales is one thing. When you’re not charging enough to generate a positive return, your firm isn’t working as efficiently as it may be. The fact that this is happening is a red warning to investors, lenders, and stockholders.

Especially if you’re searching for a loan or an investor, you don’t want a negative return to creep up on you. It is your responsibility to understand your operational cash flow (OCF), net sales, and cash flow margin.

The amount of revenue generated by your company after deducting long-term investment costs is referred to as operational cash in your firm. This would include any payments you make to your suppliers, as well as manufacturing labor and other non-cash costs.

Following that, a financial analysis of your net sales is calculated. This may be determined by calculating the amount of money you made in sales before deducting the cost of supplying the goods or services in question. Returns, promotions, and discounts are included in gross sales; however, net sales are not.

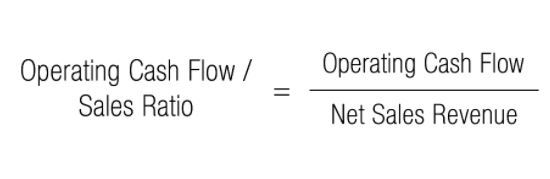

You’ll need these figures in order to calculate the cash flow margin for your organization. Once you’ve obtained them, enter them into the following formula on your financial statement:

Increases in net sales will result in a fall in operational cash flow margins, and vice versa. The question is, what do you do with this number once you’ve obtained it?

3. What To Do With Your Cash Flow In The Final Analysis.

Once you’ve calculated your net profit and determined how efficient your cash flow margin is, you may use this information to develop your next company strategy.

If your sales income is coming in on a steady basis and there aren’t many returns, your net profit margin is likely to be healthy. After all of your expenditures have been paid, your sales are converting into profits for you.

However, if your cash flow is inconsistent or negative, it is necessary to reevaluate your business approach.

As an illustration, consider the case of a hypothetical timber supplier who is reviewing their operational cash flow figures.

The supplier specializes in hardwood lumber, and each piece sells for an average of $22 per board foot, according to the company (BF). This year, the firm sold 400,000 BF, resulting in a gross profit of $8,800,000 for the year in question. It is estimated that the company’s net income would be $5,600,000 after costs of $8 per BF ($3,200,000).

Other expenditures and overhead for the corporation, on the other hand, amounted $5,400,000. The corporation was required to make a $400,000 investment in new machinery. This puts them in a difficult position, as they have a negative return of $200,000 and no free cash flow.

This statistic must be used by the business owner to determine how to proceed in order to earn a profit. As a business owner, there are a variety of strategies you may use to increase the operating cash flow of your company. At the very least, our imaginary timber firm will have to pick one of these options in order to pull themselves out of the negative territory.

4. Suggestions For Increasing Your Company’s Operating Cash Flow

With more experience in business, you will be able to see trends in your income statement and other data. As soon as you see that your company’s operational cash flow is falling, you should take action before the situation becomes a problem.

Based on the severity of your lower cash flow margin and the expected reduction, you may need to take urgent actions to protect your business.

Try one or all of the following suggestions before you start laying off staff or taking out a loan:

Instead than purchasing expensive equipment on credit, lease it instead.

Leasing isn’t always the greatest business decision, but when it comes to equipment, you may deduct the price of leasing off your taxes. When it comes to financing a lease, it is also simpler if your small business’s credit rating isn’t stellar.

Change The Terms Of Your Invoices.

It’s possible that you were overly tolerant in the past, enabling clients to pay late without incurring any penalties. A late charge may encourage you to pay your invoices more quickly.

If you provide credit, set a lower limit on the amount of credit you will issue to consumers that pay late on a regular basis. Inform them that by paying their bills on time, they may earn their way up to a greater credit limit.

Work With A Company That Specializes In Accelerated Invoicing.

While going through a difficult time, it might be tempting to turn to a typical bank loan to help you get through it. This frequently results in more hassle than it is worth. You now have monthly payments for the rest of your life to remedy a short-term problem!

If your firm relies on invoices, partnering with an expedited invoicing provider, such as Now, is a more effective method. The firm will acquire your outstanding invoices from you in exchange for a nominal charge. Because it is money that you are already owing, there is no need for a loan.

You will receive the operating cash you require to pay your expenditures until business operations resume as usual. The invoicing firm is responsible for collecting their money directly from the client. It is a business agreement that is favorable to both parties and does not contain confusing interest rates or payback requirements.

Increase The Number Of Available Payment Options.

If it is difficult for a client to pay your invoice, you will be relegated to the back burner of their priorities.

With all of the modern comforts at our disposal, we have to confess that we have become a little pampered. Click-and-pay features and automated withdrawals make it so much easier to keep track of our financial obligations!!

If your invoice requires a check to be mailed in, or if your online payment system is difficult to navigate, your customer may decide to put off dealing with your bill until they “have time.”

In contrast, if customers receive an email and are able to click on a link, store their payment method, and then push a button, they are more likely to proceed with the payment straight away.

Additionally, providing alternative easily payable ways outside a debit or credit card is beneficial. Many consumers prefer to make payments online using services such as PayPal, ApplePay, and other similar services.

Reduce Your Expenses As Much As Possible.

By investigating suppliers, you might try to lower your running expenses. Change your supplier to someone who can provide you with the same or equivalent items at a lower price.

If you’ve been loyal to a single company, you might be able to negotiate a lower deal with them. Inform them that you are looking for ways to reduce expenditures and that you have discovered a less expensive alternative. You’d want to continue working with your present supplier, but you’d like to make some changes to the terms of your agreement.

Analyze your spending report using the accounting software you’ve purchased. Where else can you make cuts to your budget in order to free up some cash?

Increase The Cost Of Your Products.

Pricing your product or service is an important aspect of running a successful business. If you price too much, buyers will look for a cheaper alternative. Failure to charge enough indicates that you will not be able to turn a profit.

If you research the market for your goods, you’ll find a happy medium somewhere in the middle.

When determining how much the consumer is spending, it’s important to incorporate taxes, shipping, and handling costs. The entire sum should be equivalent to the current prevailing market rate at the time of the transaction.

Make a thorough investigation into what your rivals are charging for the identical goods you offer, including shipping and handling. Taxes are non-negotiable and must be included in the total amount paid, as well as the total amount of money received.

If your rates are appropriate when compared to those of other firms in your field, a little price increase is to be expected. When you establish a positive reputation and rapport with your clients, the majority of them will continue to work with you. It’s less difficult to pay the tiny additional fee than it is to find someone else.

While it may not seem like much to them, it may have a significant impact on your business by increasing your growth rate. Consider the impact of a one-dollar increase in the price of your services or goods. If you sell 100,000 goods this year, you will have earned an additional $100,000 that will be added to your net profit.

It is not necessary to make dramatic changes to your procedures in order to raise your negative cash flow margin. These little tweaks have the potential to save you or make you a significant amount of money.

Conclusion.

Understanding the statistics in your company is critical to the overall success of your company. You may want the cash flow margin in order to demonstrate your company’s efficiency to potential investors or lenders, or you may just require it in order to gauge your company’s efficiency.

When you understand how to analyze financial accounts and calculate your company’s operational cash flow margin, you will be able to make important decisions about your future.

Create your Now Account today and begin experiencing the advantages of faster invoice payments right away!