A failure on the part of the borrower to satisfy certain terms outlined in the contract may trigger an acceleration clause, which provides the lender the right to seek full repayment of the amount that has been borrowed but not yet paid back. Mortgage loans and other forms of lending pertaining to real estate will most likely involve the usage of acceleration clauses.

As a result, the regulations in question protect the interests of lenders by lowering the risks associated with lending.

A failure on the part of the borrower to meet specific requirements outlined in the contract might trigger an acceleration provision in a contract, which provides the lender the right to demand full repayment of the amount that has been borrowed but not yet paid back.

Mortgage loans and other forms of lending pertaining to real estate will most likely involve the usage of acceleration clauses.

As a result, the regulations in question protect the interests of lenders by lowering the risks associated with lending.

An Example of an Acceleration Clause.

In order to completely explain this notion, we will now look at it through the lens of specific examples.

John applies for and receives a mortgage loan with a ten-year repayment term. He has been keeping up with the required monthly payments for the loan. Unfortunately, he is unable to make the payment on the installment for the fifth year.

The lending agreement now includes a condition that allows the lender to accelerate the repayment of the loan. If one or more of the scheduled payments is missed, it indicates that the borrower will be responsible for immediately repaying the outstanding balance.

If John is able to make the remaining payments on the principal amount of the loan, he will be able to purchase the property outright.

However, if he does not make the payment as agreed upon, that will be seen as a breach of the contract. As a direct consequence of this, the lender will obtain the authority to seize control of John’s property.

The house cessation is the result of the levy, which will also be mentioned in the contract. In the event that the debt is not paid, the lender has the legal authority to seize and sell any property owned by the debtor.

It is essential that you understand that the acceleration clause will not be automatically activated in the event that you are late with a payment on any of the installments. The event that sets off the trigger is the lender’s decision to activate the clause.

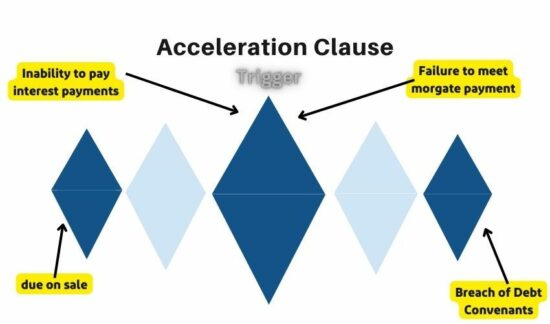

What Trigger the Acceleration Clause?

Let’s go over some of the circumstances that can prompt a lender to use this provision in the agreement they have with you.

1. Being unable to pay the interest on the loan.

In most cases, interest rates will be charged by the lender on the principal amount. The contract would specify the number of late payments that would result in the activation of the acceleration clause.

2. Due-on-Sale.

In the case of mortgage loans, you are expected to be aware that the borrower is required to secure the loan with a property. To phrase it another way, the loan is collateralized by this piece of property. Therefore, the lender has the legal right to sell off this property in order to recoup the money that was loaned to the borrower in the event that the borrower is unable to repay the loan amount. But what happens if the borrower previously sold the property that was secured by the mortgage?

For such circumstances, Due-on-Sale comes as a rescue. In the context of mortgage loans, it is referred to as a covenant. If the borrower sells the property that was used as collateral for the loan, it provides the lender with the ability to more easily demand full repayment of the loan’s principal amount.

3. Failing to Keep Up with Monthly Mortgage Payments

This particular trigger for an acceleration clause arises most frequently in real estate loans, which typically entail extremely large loan amounts. In circumstances like these, the repayment is typically carried out at predetermined intervals through the utilization of mortgage payments and interest payments. In the event that any of these payments are not honored, the clause will be triggered.

4. A Violation of the Covenants Regarding the Debt

Debt covenants are conditions placed on the borrower by the lender that restrict their behavior in order to protect both parties’ interests. These provisions of the agreement set forth the exact guidelines that the borrower is obligated to follow. The lender reserves the right to demand full repayment of the remaining balance of the loan in the event that the borrower violates the conditions stipulated in this covenant. In addition to that, it will result in a violation of the covenant.

Acceleration Clause vs Alienation Clause.

- Recognize that the two provisions are distinct from one another. The Alienation provision can also be included in contracts for insurance and financial services, in addition to mortgage loans.

- If the party that is borrowing money does not satisfy the financial responsibility that is outlined in the contract, this clause will allow the asset in question to be transferred to another party or sold.

- This phrase works in the borrowers’ interest in some way. If the lender has already recovered the remaining balance of the loan through the sale of the mortgaged property, then the borrowers are released from any further need to make payments on the loan.

- In this scenario, the debtors are not relieved of their obligations under the contract until after the property has been sold to a new owner.

Advantages.

Is this clause advantageous for lending institutions? Is there any good that may come from this for the borrowers? We are going to provide such insights by highlighting the positives and negatives associated with this idea.

- Bad debts are something that frequently takes place in the world of loans. It assists the lender in recovering the amount that was loaned in the event that the borrower does not make payments when they are due.

- As a result, the likelihood of the lender losing the money that was loaned is significantly reduced. As was just indicated, if an acceleration clause is activated, it will require the borrower to either return the loan or sell or mortgage his property to the lender in order to avoid the clause’s consequences.

- The borrower is released from any additional obligations to make payments prior to the maturity of the loan after the payment has been processed.

- Some of these clauses offer comfort to the borrowers because they specify that the clause would be activated after the borrower has missed two or three installments of the loan payment.

Disadvantages.

- This is typically not in the best interest of the borrower because it requires immediate payment of a significant sum of money, which may be impossible to come up with on such short notice.

- It’s possible that the terms and conditions of the acceleration clauses will appear to be too complicated to comprehend. As a result of this, people frequently seek the assistance of a lawyer in order to have a better understanding of the nuisances posed by the laws and the trigger points.

- When it goes into effect, it puts the debtors at risk of losing not only the money they had paid into the loan, but also the property that it’s secured by.