In order to establish a company’s operating cash flow ratio, cash flows generated by the company’s operations are taken into account. Short-term liquidity can be estimated using this ratio for a company’s short-term liquidity. Because earnings can be easily manipulated, it is more accurate to evaluate cash flow rather than net income in order to ensure accuracy.

Important Considerations

- An organization’s financial health can be determined by determining if its normal operations are sufficient to meet its short-term obligations. The operational cash flow ratio can be used to determine this.

- The ratio increases when more cash has been earned in a period than has been immediately necessary to pay off current liabilities. A higher ratio indicates that the firm has more cash on hand.

- The cash flow from operations (CFO) metric is preferred over net income since it is more difficult to manipulate the numbers using accounting gimmicks.

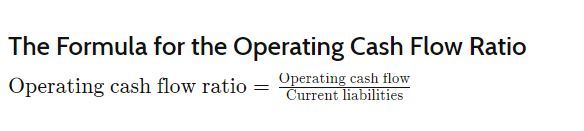

The Formula For The Operating Cash Flow Ratio

The operational cash flow to current liabilities ratio is calculated by dividing operating cash flow to current liabilities by total current liabilities. Operating cash flow refers to the money that a company generates in the course of conducting its normal business.

Components Of A Operation Cash Flow Ratio

Businesses earn profits, which are then used to offset the cost of goods sold (COGS) and other operating expenses, such as legal fees and utilities. The monetary equivalent of cash flow from operations is referred to as net income. A company’s cash flow is defined as the entire amount of money available to the company after all operating expenses have been deducted and before any new investments or financing activities have been undertaken.

As a result, investors prefer to focus on cash flow from operations rather than net income because there is less margin for mistake. The quality of a company’s earnings, on the other hand, can be determined by examining both operating cash flow and net income.

All current obligations are those that are due within one fiscal year (FY) or one operating cycle (whichever is longer), and are referred to as “current liabilities.” They are frequently classified as short-term liabilities on a balance sheet because of their short maturity.

Here’s How To Figure Out Your Operating Cash Flow Ratio:

It is a measure of how many times a company’s present debts can be paid off with the income it creates in a certain period of time. High numbers indicate that a company has generated more cash than it will require to pay down its current liabilities over the course of time.

An operating cash flow ratio less than one indicates that the company is unable to satisfy its existing obligations due to a lack of cash generated by operations. An investor’s perspective is that a low ratio could imply that the company is short on cash flow.

It is important to note that there are many possible interpretations, and not all of them point to low financial standing. In some cases, businesses may decide to embark on a project that may initially restrict their cash flow but will ultimately pay off handsomely in the long run.

When The Operating Cash Flow Ratio Is Compared To The Current Ratio, The Difference Is Significant.

The ability of a corporation to pay short-term debts and commitments can be established by looking at both the operating cash flow and the current ratio of the organization.

The operational cash flow ratio is calculated on the assumption that operating cash flow will be sufficient to meet current obligations (i.e., current liabilities). Current assets are assumed to be employed in the calculation of the current ratio in this scenario.

The Exemplification Of The Operating Cash Flow Ratio (OCFR).

Take, for example, Walmart and Target, two retailing behemoths. As of February 27, 2019, both corporations have $77.5 billion in current liabilities, with one company having $17.6 billion in current liabilities and the other having $77.5 billion. Walmart generated $27.8 billion in operational cash flow in the preceding year, but Target generated $6 billion in operating cash flow in the same period.

Walmart’s operating cash flow ratio is 0.36, or $27.8 billion divided by $77.5 billion, which is equal to $27.8 billion divided by $77.5 billion. Divide Target’s annual revenue of $17.6 billion by the company’s operating cash flow ratio of 0.34, and you obtain a total of $6 billion. As evidenced by their identical liquidity ratios, both companies had comparable liquidity. In order to further validate that the two companies had comparable liquidity profiles, we observed that their current ratios were likewise equal.

The Operating Cash Flow Ratio Has Its Limits When It Comes To Financial Analysis.

It is possible for businesses to manipulate operating cash flow ratios, but it is not nearly as prevalent as manipulating net income. Some businesses deduct depreciation charges from their revenues, despite the fact that they do not represent an actual loss of cash in the financial statement.

During the course of their useful lives, assets are depreciated in accordance with an accounting convention known as depreciation. As a result, depreciation should be included in an organization’s cash flow from operations to account for the additional expense.