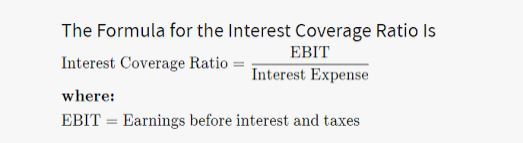

When a company’s ability to make interest payments on its outstanding debt is examined, it is referred to as the interest coverage ratio (ICR). The interest coverage ratio is computed by comparing a company’s debt to its revenue. When a corporation’s pre-tax earnings are divided by the interest expense incurred over a certain period, the interest coverage ratio of the corporation may be calculated. In this article is going to explain what is the interest coverage ratio and what is effect of it for the company.

The interest coverage ratio is sometimes referred to as the times interest earned (TIE) ratio in some circles. In order to analyze the credit risk of a firm based on its present debt or predicted future borrowing, lenders, investors, and creditors typically employ this strategy.

These Are Important Facts To Know

- It is necessary to calculate the interest coverage ratio in order to determine a company’s ability to make interest payments on its outstanding debt.

- It is possible to calculate the interest coverage ratio (ICR0 of a corporation by dividing the company’s pre-tax earnings by the interest expense incurred during a specific period.

- If EBIT is not available, EBITDA or EBIAT may be substituted for EBIT in the calculation.

- An increase in coverage ratio is generally preferable, though the optimal ratio may fluctuate depending on the industry.

Understanding The Interest-To-Cost Ratio Is Essential.

Over a period of time, an interest coverage ratio is a measure of how long a company’s present revenues can be utilized to pay interest payments on a loan or other debt. Essentially, it is a measure of how many times a company’s earnings can be used to pay off all of its debts.

The lower the debt-to-capital ratio, the greater the burden of debt on the firm and the less accessible capital for other uses the corporation has. An interest coverage ratio of 1.5 or less reflects a company’s ability to satisfy its interest expenditures in the future.

The ability of businesses to repay their interest payments is essential for them to be able to endure any unexpected financial troubles that may arise in the future. As a result, the ability of a company to meet its interest commitments is an important component of its solvency, and as a result, of its return on equity.

The Importance Of The Interest Coverage Ratio

Ability to meet interest-payment commitments is a constant and pressing concern for any organization that incurs debt. Companies that are having problems fulfilling their financial obligations may be forced to take on new debt or use cash reserves that would be better allocated to capital asset investments or cash flow crises rather than satisfying their obligations.

An examination of a company’s long-term interest coverage ratios may disclose a great deal more about the financial health of the company than merely examining a single interest coverage ratio alone.

Examining a company’s interest coverage ratios, which have been calculated on a quarterly basis for the past five years, is a great approach to assess its short-term financial health. This will demonstrate to investors whether the ratio is improving, declining, or remaining stable.

Aside from that, the level of desirability associated with any given ratio is a matter of individual preference. If a lower payout ratio is offered in exchange for a higher interest rate on the company’s debt, some investors may be ready to accept it.

Here Is An Example Of ICR To Demonstrate The Concept:

Assume that a corporation’s quarterly earnings total $625,000 and that the company is compelled to make monthly loan payments of $30,000 in order to maintain its operations. In order to calculate the interest coverage ratio in this case, one would need to multiply the monthly interest payments by three, as shown below. Divide $625,000 by $90,000 ($30,000 multiplied by three) and you get 6.94. Currently, there are no liquidity difficulties affecting this organization.

In the business world, a 1.5 interest coverage ratio is usually regarded as the lowest acceptable ratio for a company, as well as the point at which lenders are likely to refuse to lend the company any more money since the company’s risk of default has been determined to be too high.

Because of the factors stated above, companies with debt-to-equity ratios lower than one may find it essential to delve into their cash reserves or take on new debt, both of which are difficult decisions. Even if the company experiences a one-month loss of revenue, it is still at risk of going bankrupt.

Various Interest Coverage Ratios Are Available.

Before examining a company’s financial ratios, it’s important to understand the difference between two commonly used versions of the interest coverage ratio. These disparities are a result of changes in EBIT margin.

EBITDA

When computing the interest coverage ratio, it is possible to utilize EBITDA rather than EBIT as a metric. The use of EBITDA rather than EBIT, as opposed to the usage of EBIT, produces a larger numerator than the use of the EBIT figure. The fact that the interest expense is the same in both situations means that EBITDA calculations will result in a larger interest coverage ratio than EBIT calculations for the same amount of capital.

EBIAT

Using EBIT (earnings before interest and taxes) instead of earnings before interest and taxes, another method of calculating the interest coverage ratio can be used (EBIAT). The removal of tax expenses from the numerator also helps to improve the precision with which interest charges are represented as a company’s ability to pay its debts and interest. Rather than using EBIT as the basis for interest coverage ratio calculations, it is preferable to use EBIAT since it provides a more accurate picture of a company’s ability to pay its interest expenses over time.

Restrictions On The Interest Coverage Ratio

Before using the interest coverage ratio as a measure of a company’s efficiency, it is critical for investors to understand the limits of the ratio.

As is well known, the interest coverage provided by firms in different industries, and even by companies within the same industry, varies significantly. In some areas, such as the utilities industry, having an interest coverage ratio of two is considered a good standard for well-established firms.

Due to steady output and revenue, a well-established utility may be able to satisfy its interest payments despite having a low interest coverage ratio, in part due to government constraints. Industries such as manufacturing, which are notoriously unstable, may withstand interest coverage ratios of up to three, according to the Federal Reserve.

Businesses in this industry are more likely to suffer ups and downs than those in other industries. As an illustration, automotive sales decreased dramatically in 2008, which had a detrimental influence on the auto manufacturing industry. 1 Employee walkouts are yet another example of unplanned events that could have a negative impact on interest coverage ratios. The ability of companies in these industries to fulfill their interest costs more effectively must compensate for periods of decreased revenue.

Given the wide range of differences within industries, a company’s ratio should be compared to that of other firms in the same industry—and, ideally, those with similar business strategies and revenue numbers—in order to be meaningful.

Companies may choose to exclude or isolate specific types of debt from the calculation of their interest coverage ratios, despite the fact that all debt must be included in the calculation of the ratio. Consequently, it is crucial to confirm that all debts are included in a company’s self-published interest coverage ratio before investing in the company.

When It Comes To ICR, ‘What Can You Learn From It?’

The interest coverage ratio, which measures a company’s ability to pay its debts, is a financial ratio. A number of different debt ratios can be used to evaluate the overall financial health of a corporation. For the purposes of this definition, the term “coverage” refers to the number of fiscal years for which interest payments can be made with the current earnings of the company in question. Essentially, it is a measure of how many times a company’s earnings can be used to pay off all of its debts.

In Order To Calculate ICR, What Is The Formula To Use?

The ratio is calculated by dividing annual EBIT (or any variant thereof) by interest on debt expenses (the cost of borrowing capital), which is the cost of borrowing capital.

Which ICR Is The Most Appropriate For Your Situation?

A debt-to-equity ratio greater than one indicates that a company is able to pay the interest on its loans out of its earnings or that it has demonstrated the ability to maintain revenues at a relatively consistent level. When comparing the minimum acceptable level of 1.5 interest coverage ratio, analysts and investors prefer an interest coverage ratio of at least two. For firms with historically more variable revenues, the interest coverage ratio may not be considered appropriate until it is significantly higher than three.

Does A Bad ICR Have An Impact On The Business?

This implies that the firm’s current earnings are insufficient to pay off its outstanding debt, and an interest coverage ratio of less than one suggests that the company is in financial trouble. The likelihood that an organization will be able to cover its interest costs on an ongoing basis is low even with an interest coverage ratio of less than 1.5, especially if revenue varies seasonally or cyclically.